Politics created the biggest market headlines last week. Investors wrestled with the tone of the presidential debate and how it contributes to political uncertainty. Stimulus negotiations between the House and the Trump administration narrowed the gap between the two parties, but they were unable to produce a deal. The president contracting COVID-19 contributed to the sense of uncertainty.

Key Points for the Week

- Political uncertainty increased last week, fueled by an antagonistic presidential debate, stimulus negotiations, and the president contracting COVID-19.

- The U.S. economy created 661,000 jobs in September, indicating the economic recovery lost momentum.

- The slow recovery in many industries contributed to 345,000 unemployed workers reclassifying their unemployment as permanent.

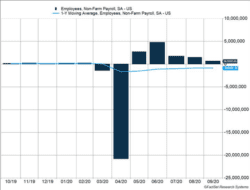

In contrast to the political landscape, last week’s economic data behaved about as expected. The U.S. economy created, or in many cases regained, 661,000 jobs. (See Figure 1.) While missing expectations of 858,000, it matched our core expectation the economic recovery will continue at a slowing pace. The job gains pushed unemployment down to 7.9%.

The job gains have reduced the number of temporarily unemployed from a peak of 18 million to just more than 4 million. Most of the reduction came from workers being rehired. But more than 2 million have reclassified their unemployment from temporary to permanent, meaning their former positions are lost and they face the more difficult task of finding new employment in a slowing recovery.

So, naturally, the S&P 500 gained 1.5% last week and evidenced the tenuous link between political and market performance. The MSCI ACWI index increased 1.7% as global stocks swung back to positive performance after a brief dip. The Bloomberg BarCap U.S. Aggregate Bond Index dropped 0.1%. For the month, the S&P 500 dropped 3.8% while soaring 8.9% in the third quarter.

Figure 1

Closing out the Year

The last six months have seen an incredible set of returns for the stock market. The S&P 500 is up 31.3% for the last two quarters. After the sharp downturn in the first quarter, such a sharp bounce back in the market was unexpected. At the time, investors were spending more time talking about a retest of the previous lows than a sharp run to all-time highs. This rally occurred despite coronavirus cases being more numerous and more damaging than most expected.

As we move into the fourth quarter, many people are turning their attention to presidential politics as the most important factor to watch. Last week provided plenty of political movement. The presidential debate was followed swiftly by the president announcing he was infected by COVID-19 and going to Walter Reed for treatment.

Given the surprising turn of events, we would expect to see several strong moves in the market. Instead, the S&P 500 only moved by 1% or more one day last week. That was Monday, prior to the debate and the president’s diagnosis. The muted reaction suggests politics is not the most important factor moving markets.

These are the three factors we believe have the potential to move markets more than political issues.

- Progress on a vaccine: The most important results being shared in October and November are the effectiveness and side effects of the numerous vaccines being evaluated to prevent COVID-19 from continuing to spread. The recent surge of cases in the Midwest and Europe show how difficult COVID-19 will be to contain without additional medical advances. The ability to return to large gatherings and greater mobility is crucial to many businesses, and vaccines represent the best path toward a recovery.

- Avoiding monetary and fiscal policy mistakes will be crucial in the intervening months. The current stalemate over an additional stimulus bill worries markets because economic momentum is being lost. Policy mistakes can come from many parts of the world. China can continue to focus on its own growth and seek its own advantage rather than create policies designed to benefit the rest of the world. Great Britain and the European Union can fail to appreciate how a challenging Brexit can sap the minimal economic momentum in Western Europe.

- The economy can lose the contest to the virus. As we covered in previous months, one of the contests affecting markets is whether the economy can be safely reopened to allow economic activity to occur without spreading the virus too quickly. The recent upswing in cases shows those objectives are difficult to balance. Last month the economy produced 661,000 new jobs. Yet, as many celebrated returning to work, 345,000 more people classified their unemployment as permanent, rather than temporary. The slow job growth shown in Figure 1 points to an economy unable to expand in the face of a pandemic and declining government support.

So, enjoy the vice-presidential debate this week and stay glued to social media and cable news for updates on the campaign and the president’s condition. Keep in mind, while these events may be very important to the long-term direction of many key issues, they may not affect your portfolio that much. Our focus will be on the issues above as the most important drivers to watch.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.bls.gov/news.release/empsit.nr0.htm

Compliance Case: 00860690