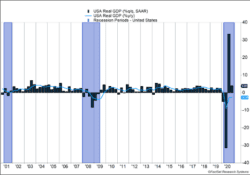

The U.S. employment situation remains lackluster. Only 49,000 new jobs were created in January. Unemployment dropped but only because labor force participation fell from 63.4% to 61.4% (Figure 1). As COVID-19 cases have dropped this year, some improvement is expected in coming months. Vaccine distribution remains the most important path toward an improved economy.

Key Points for the Week

- The U.S. economy produced only 49,000 jobs in January. Unemployment dipped to 6.3% but only because some unemployed workers stopped seeking work.

- The Federal Reserve left interest rates unchanged and reiterated it has no plans to raise rates soon.

- S&P 500 earnings look likely to increase in the fourth quarter as corporations are beating earnings by wider-than-normal margins.

In the meantime, the Biden administration is working with allies in Congress to pass another stimulus program. Additional payments and supplemental aid for the unemployed are part of the package that also steers more money to municipalities. The Federal Reserve remains committed to delaying any interest rate increases until the economy shows a significant risk of inflation or has made great progress toward a stronger recovery.

Equity markets responded positively to the news of additional stimulus and the promise of low rates. The S&P 500 soared 4.7% to swing back into positive territory for the year. The MSCI ACWI index surged 4.3%, and the Bloomberg BarCap Aggregate Bond Index sagged 0.4% as optimism about an economic stimulus pushed interest rates higher. Bond prices move in the opposite direction of interest rates.

This week, inflation data will be the chief economic data point to monitor, although perhaps not enough of a distraction for football fans of someone other than Tom Brady.

Figure 1

Back to Core Principles

Investment markets reacquainted themselves with the fundamentals last week, and the news was generally good. After a week in which patient investors seemed to make a Jekyll and Hyde transformation into rabid speculators, it was a healthy step for the market to focus on interest rates and earnings rather than short interest and discussion boards.

Amidst the hoopla two weeks ago, the Federal Reserve assured investors rates would remain favorable for an extended period. The Fed left rates near 0% and remains committed to purchasing government bonds to keep long-term rates lower until the economy has made “substantial further progress.”

More stimulus support seems likely to forestall additional economic damage until a vaccine can allow individuals to interact more with each other. The Biden administration is targeting an additional $1,400 in direct payments to a slightly smaller group of individuals than those supported by previous packages. Supplemental unemployment benefits of $400 are likely to continue through September. Additional aid to cities and support for reopening schools is included in the plan.

The boost in aid will likely spur consumption (and widen our trade deficit with China) as restrictions of business activity and concerns about COVID-19 continue to inhibit purchases of services. Many goods trace some of their components back to China. Even with some unintended side effects, the aid will help some people in difficult straits. Only 56% of the jobs lost in the first part of the year have been regained, and only 49,000 new jobs were created last month (Figure 1). The difficulties in some industries remain acute, and more than 4 million people have been out of work for more than 27 weeks in the U.S.

Corporate earnings are also supporting markets. Fourth quarter earnings expectations have shifted from contraction to growth. Fourth quarter S&P 500 earnings are now projected to grow 1.7% with about 60% of companies reporting. At the end of the fourth quarter, earnings were expected to contract 9.3%. Corporations seem to be weathering COVID challenges better than expected.

A return to fundamentals is welcome. The mania-like behavior in investment markets not only unleashed the desire for rapid gains, it also raised questions about how markets are designed to function. Sometimes markets take time to reflect reality. Being patient and focusing on the basics can be valuable traits in investing and in life.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.worldometers.info/coronavirus/country/us

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20210127.pdf

https://www.bls.gov/news.release/pdf/empsit.pdf

https://insight.factset.com/sp-500-earnings-season-update-february-5-2021

Compliance Case # 00947081