[vc_row][vc_column][vc_column_text]

Client Only Webinar: Everyone has heard of the 60/40 portfolio but challenges lie ahead with this approach.

Join Debbie Taylor and Special Guest Speaker, Brad Eckstein, Regional Manager for Lord, Abbett & Co.LLC

Thursday, March 4th at 4:15 PM EST

Here’s what Debbie and Brad will address:

1. Stocks and how they may be considered overvalued or at frothy levels

2. Find out why the problem with the 60/40 is the 40 – not the 60

3. Core Bonds in the time of low-interest rates and possible losses associated to them

4. Why Core Bonds don’t provide capital appreciation or much income

5. How Bonds could create losses and what a savvy investor needs to think about now

FEBRUARY IS TFG TAX MONTH (NEW)

“Dirty Dozen” Tax Scams to Watch For

Resource Provided by Taylor Financial Group, LLC

Every year the Internal Revenue Service (IRS) releases its list of tax scams, spotlighting the myriad ways that people try to separate you from your money… Read More

How Filing Your Tax Return Early (or Late) Could Boost Your Third Stimulus Check

Kiplinger Article Provided by Taylor Financial Group, LLC

There are plenty of good reasons to file your tax return early this year. You’ll get your refund faster, it cuts down on tax identity theft, and there’s one less thing to worry about for the next few months. Plus, for some people, it could also mean a bigger third stimulus check! …Read More

CURRENT STATE OF THE MARKET (NEW)

Weekly Market Commentary 02.22.2021

Inflation Remains Low, S&P 500 Earnings Continue to Be Strong

Published by The Carson Group, LLC

American consumers put their stimulus checks to work last month. Retail and food service sales rose 5.3% in January, after declining 1.0% in December (Figure 1). Compared to one year ago, sales are 7.4% higher. The strong data resulted from the stimulus checks and declining virus cases. Because of restrictions and risk, the biggest winners were online retailers. Home improvement stores also experienced strong demand as consumers continue to spend extra time at home…..Read More

MARKET UPDATE (NEW)

TFG’s Monthly Investment Update (February 2021)

The House View Provided by Taylor Financial Group, LLC

These markets continue to shock and awe. Aside from the entertainment value, there is plenty to keep an eye on. With that in mind, see below four themes we are watching closely for the remainder of February, as well as our current asset allocation tilts… Read More

COVID-19 HEALTH AND WELLNESS (NEW)

The Destinations Open to Travelers Vaccinated Against Covid-19

CNN Article Provided by Taylor Financial Group, LLC

As the Covid-19 pandemic continues to wreak havoc on the travel industry, countless destinations around the world are rolling out vaccines to their most vulnerable citizens.

The UK has already vaccinated over 15 million people, while the US is currently administering 1.6 million shots a day.

Meanwhile, Denmark has announced plans to launch a coronavirus digital passport by the end of February that will act as documentation the holder has been fully vaccinated against Covid-19…..Read More

School’s out- Getting America’s children back into class

The Economist Podcast Provided by Taylor Financial Group, LLC

NEARLY HALF America’s children are yet to return to the classroom a year after the pandemic began. President Biden says it’s a national emergency, but he has already diluted a pledge to reopen the majority of schools in his first 100 days. Why is getting back to school so hard?…Listen Now

KEY PLANNING & INVESTMENT DEADLINES YOU DON’T WANT TO MISS (NEW)

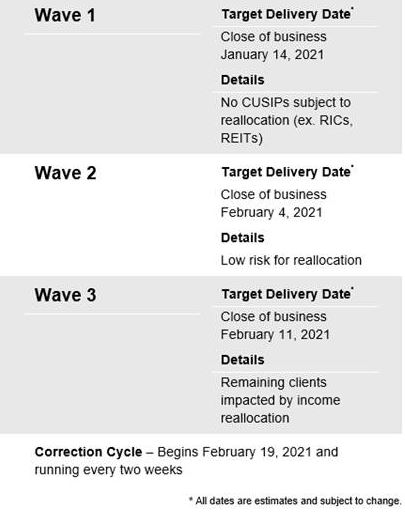

IMPORTANT ANNOUNCEMENT ABOUT FILING YOUR TAXES (ICYMI)

TD Ameritrade will be issuing 3 rounds of Form 1099s for 2020. Taylor Financial Group recommends that you NOT file your 2020 taxes until the 2nd correction cycle has been issued on March 5th.

Upon your request, TFG will securely email your 1099s to you and your tax professional or just to you, based on your preference. Please let us know.

MEDICARE UPDATE (ICYMI)

1) Yes, your Medicare Part B coverage WILL COVER your COVID-19 VACCINE 100%… Read More

2) Now’s the time for a Medicare Supplement Checkup. You can replace your Supplement at any time if you’re overpaying and in generally good health

- If you are overpaying and can pass underwriting (a health history lookback), you can often get the same great coverage at a lower premium by switching insurance companies.

- Make sure you do a Medicare Supplement Checkup every two to three years.

3) You can change your Medicare Advantage (MA) Plan from now through March 31, during the annual Medicare Advantage Open Enrollment Period (MA OEP)

·During the MA OEP, you can switch from your Medicare Advantage Plan to:

- another Medicare Advantage Plan, OR

- to Original Medicare with or without a prescription drug plan (Part D).

· You can make just one change during this period, to start the first of the following month.

4) You can sign up for Original Medicare Part A and/or Part B from now through March 31 if you missed your Medicare Initial Enrollment Period around your 65th birthday or when you left your employer’s health insurance.

- Enrolling during this annual General Enrollment Period (GEP), which runs from January 1 – March 31, means your coverage will start on July 1.

- Until that time, you will not be covered by Medicare.

- In addition, you may have to pay a Part B premium penalty for the months you’re without Medicare.

Have Medicare questions or want help? Book a no-charge Medicare check-in now with Nancy Schwartz, Medicare Coach & Licensed Independent Insurance Broker.

Nancy connects people like you with the right Medicare coverage at the best price. Her services are free to every client.

[/vc_column_text][/vc_column][/vc_row]