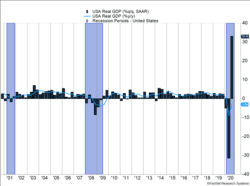

Last week, markets moved less on the recovery of today and more on the uncertainty of tomorrow. U.S. GDP increased 33.1% (see Figure 1) after a massively negative report last quarter. Strong growth in consumer spending provided the biggest push to the overall economy. Earnings also continued to improve. Originally forecasted to drop 21.1%, strong earnings from internet-based businesses cut the expected dip to 9.8%.

Key Points for the Week

- Surges in COVID-19 cases and the response by governments around the world are raising concerns about the pace of the economic recovery.

- U.S. GDP increased 33.1% last quarter as businesses reopened and fiscal policy support pushed consumer spending sharply higher.

- The S&P 500 dropped 5.6% last week as uncertainty surrounding the pandemic, earnings, the U.S. election, and earnings expectations weighed on shares.

Uncertainty seemed to manifest itself frequently. The increased COVID-19 case levels threatens the speed of the global recovery while economic growth appears to be decelerating. Policy and election risk are having some effect. So is uncertainty regarding when vaccines might be available and how effective they will be at allowing people to resume more normal levels of activity.

Because uncertainty reigned, markets dropped. The S&P 500 gave back 5.6% last week. The MSCI ACWI index sagged 5.3%. The Bloomberg BarCap U.S. Aggregate Bond Index was essentially unchanged.

The U.S. election and employment report will headline this week’s news. For some perspective on the election, please see Senior Investment Strategist Scott Kubie’s viewpoint on politics and your portfolio. The employment report will show how many jobs are being reclaimed and how many are being lost permanently as restrictions are reenacted in some communities.

Figure 1

The Four Es: Epidemic, Economy, Election, and Expectations

The U.S. stock market buckled this week as the “Four Es” continued to shape market expectations. This week’s update will explore each of these four items and how they moved markets in recent weeks.

1. Epidemic: COVID-19 cases were dropping in most areas, but a surge in the Midwest has created an epidemic within the broader pandemic. Investors remain concerned the continued outbreaks will force governments to reintroduce business closures. Some European countries have also reintroduced restrictions. When businesses restrict activity or shut down, jobs are lost and consumption drops. Those individuals affected and the firms that employ them would benefit from additional government assistance.

There has also been little information about the effectiveness of vaccines. Information about the studies isn’t expected to be released until a certain number of COVID-19 cases occur in either the vaccine or placebo group.

2. Economy: At first glance, you would think a 33.1% improvement in GDP that beat expectations by more than 1% would be celebrated. (See Figure 1.) But the rebound in the economy was primarily driven by reopening that occurred months ago. The data indicate the recovery is gaining back some of the ground it lost, but not nearly as much in recent months as at the start of the quarter.

Services remain the weakest part of the recovery. Even with growth of 8.2%, service businesses remain 7.2% below year-ago levels. Goods, on the other hand, grew 9.8% and are 6.9% ahead of last year.

3. Election: For those of you in competitive districts, take comfort in the fact the election is almost over. The ads are about to end. How the market reacts to the election results is difficult to predict. In 2016, the overnight futures market plummeted on the news Donald Trump had been elected but by morning decided it wasn’t so bad.

The ability to declare winners in the presidential and U.S. Senate races will be of great interest. Investors seem to be balancing the desire for additional economic support with the risk tax increases may hurt corporate profits and slow a potential recovery. We expect a Republican-controlled Senate will make passing a larger financial support package and tax increases more difficult.

4. Expectations: “Rose-colored binoculars” is a phrase we have shared in our commentary to describe how investors are approaching the markets. Rose-colored connotes an optimistic bent and binoculars indicates investors are looking farther into the future than normal. For long-term investors, it is probably a good way to approach markets.

The short-term risk of holding this view is sometimes other investors shorten their horizons and simultaneously become more pessimistic. The result is a bumpier experience. Markets seem to have entered this stage again. Earnings and economic data were good, but future growth is cloudier. Potential vaccine providers haven’t released much new data while new cases are spiking.

Some of these challenges are ongoing while others are nearing resolution. Vote counting will be over soon. Earnings season is almost done, too. Vaccine news should be forthcoming. The future is about to get a little clearer.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://covidtracking.com/data/national

https://www.bea.gov/news/2020/gross-domestic-product-third-quarter-2020-advance-estimate

https://insight.factset.com/sp-500-earnings-season-update-october-30-2020

https://www.bbc.com/news/explainers-53640249

Compliance Case: 00898579