The S&P 500 declined for the fourth straight week. On Wednesday, the index of large U.S. companies had declined just more than 9.5% but rallied late in the week. The S&P 500 is 7.8% below its Sept. 2 high. The four-week decline has matched the characteristics of a price adjustment after a large run-up in markets. The stocks with the largest gains have dropped the most, and less-risky stocks are falling less than the overall market.

Key Points for the Week

- The S&P 500 fell short of a 10% decline and then rallied late in the week to finish 0.6% lower last week.

- Durable goods orders rose 0.4% — more evidence that goods are recovering more quickly than many services.

- New housing starts skyrocketed behind the power of low interest rates and a record-low supply of existing homes.

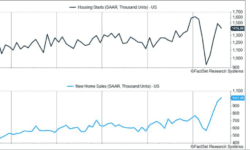

Economic data continued to support our thesis that purchases of goods will recover more rapidly than services. Durable goods rose 0.4% and are now down 4.6% over the last 12 months. Housing markets continue to rally. New home sales increased to more than 1 million last month as families reassessing their living situations pursued more space while the number of existing homes for sale dropped. (See Figure 1.)

The S&P 500 dipped 0.6% last week. The MSCI ACWI index sank 2.1% as global stocks gave back recent gains to the U.S. market and the dollar strengthened against other currencies. The Bloomberg BarCap U.S. Aggregate Bond Index dropped 0.1%.

This week offers all sorts of excitement. The first presidential debate on Tuesday will be followed by an employment report on Friday. The debates take on extra importance when COVID-19 limits opportunities for other campaigning. The jobs report will give investors a fresh update on the health of the U.S. market and shed light on how quickly workers are being rehired. The report also estimates how many of those workers still anticipate returning to a former job or whose unemployment is now permanent.

Figure 1

Building a New Foundation

The S&P 500 avoided a correction last week by about half a percent. While declining for the fourth straight week, U.S. large-cap stocks rallied late in the week and limited the losses to just 0.6%. This decline appears very normal in a year when almost everything else is so strange.

What does a normal downturn look like? When it takes place after a big rally, like we have seen from the March lows, we expect the market to exhibit a few key patterns.

- The market may decline by around 10% with relative frequency. Declines of this size are a normal part of investing. Just because the market dropped more than 20% earlier this year doesn’t eliminate normal volatility. The surprising part about this downturn was how long it took to occur. The S&P 500 rallied more than 61% from its March lows through Sept. 2.

- Less-volatile stocks should do better than more-volatile ones during the decline. The S&P 500 Low Volatility Index has dropped 4.8% during the decline while the S&P 500 is down 7.8%.

- The stocks that have done the best will give back more of their gains. Growth stocks have outperformed value stocks by a wide margin this year. During the decline, the Russell 1000 Value Index has declined 5.9% compared to the Russell 1000 Growth Index’s decline of 9.1%

Expect the volatility to continue. On the surface, the market is expected to remain volatile. More people contract COVID-19 every day. A major election looms in the U.S. and the effectiveness of a vaccine will be very crucial for the near-term success of many enterprises. As these issues get resolved, they will provide the foundation for determining how quickly the world can recover from COVID-19.

While this market decline is behaving according to expectations, three key data points released last week suggest the global economy will heal differently than it does from traditional downturns.

- New orders of durable goods rose 0.4%. While still 4.6% below last year’s level, the improvement shows businesses and individuals are migrating toward a greater emphasis on goods while services recover at a slower rate.

- Trade activity is recovering more quickly. In the financial crisis, trade didn’t bottom for eight months. With COVID-19, trade bottomed after three months and has bounced back to only 10% below peak trade levels.

- Housing is staging a major recovery as new home sales have increased more than 40% since the end of 2019. (See Figure 1.)

This last trend is particularly noteworthy as trends in residential real estate are aligning for a continued rally. Rates are very low because the Federal Reserve has cut rates and purchased mortgages and Treasury bonds to push rates lower. Many workers are confident they will retain their jobs but realize they will be spending a lot more time at home. The homes they own were not purchased for a world of work from home and school from home. At the same time, millennials are providing a demographic boost to housing demand.

Alternatives to homeownership also look less attractive. Travel has become riskier. Retirement homes have become less attractive while second homes seem a more practical option than before. COVID-19 has created a world where many people have an incentive to move; yet, existing homeowners are staying put. This month’s housing data showed the trend toward housing may be stronger than anticipated.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.census.gov/manufacturing/m3/adv/pdf/durgd.pdf

https://www.census.gov/construction/nrs/pdf/newressales.pdf

https://www.census.gov/construction/nrc/pdf/newresconst.pdf

https://www.wsj.com/articles/globaltradereturns-faster-than-expected-11600594200

Compliance Case: 00835896