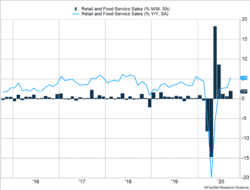

Retail sales rebounded as U.S. consumers continued to put salaries and money left over from the CARES Act into the economy. Retail and food service sales surged 1.9%, more than doubling expectations of 0.8%. The gains raised overall retail sales 5.4% above year-ago levels as consumers make up for consumption lost during the early days of social distancing (Figure 1).

Key Points for the Week

- Retail sales surged 1.9% last month and are up 5.4% since one year ago as consumers make up for ground lost during the early stages of the pandemic.

- Initial employment claims rose 53,000 last week, indicating employment is not recovering at the same pace as retail sales.

- A surge in coronavirus cases in Europe and the Midwestern U.S. are a threat to the economic recovery.

The strength in retail sales contrasts to weaker inflation, higher initial unemployment claims, and declining industrial production. The Consumer Price Index rose 0.2% and would have been negative except for a surge in used car prices. Initial unemployment claims increased 57,000 as more companies announced layoffs. Industrial production slid 0.6%.

The market had a mixed reaction to the flurry of data. The S&P 500 gained 0.2% last week. Global stocks slipped, as the MSCI ACWI index dipped 0.2%. The Bloomberg BarCap U.S. Aggregate Bond Index edged 0.2% higher.

The final presidential debate will grab considerable headlines as polling data points to continued gains by Democratic candidates. Economic data will be led by Chinese third quarter GDP. The world’s second largest economy is expected to rebound around 5% and is recovering more quickly than U.S. and European economies.

Figure 1

The Latest Polling Data

Economic reports are a lot like polling data. The initial reports are based on samples that are adjusted for certain factors and then shared with the public. The economic reports provide an assessment to business leaders, investors, and policymakers on how well the campaign for a better economy is working. This week’s polls indicated the economy continues to press forward, but there are weaknesses in some areas.

The consumer provides the strongest evidence for the economy continuing to make steady gains. Retail sales and food service sales surprised to the upside, climbing 1.9% last month. (Figure 1 – bars). Even when dropping the more volatile categories of autos, gasoline, and food services (restaurants), sales still beat estimates, rising 1.4% for the month and 10.1% for the year.

As the year-over-year comparison shows (Figure 1 – line), the broadest definition of retail sales grew 5.4%. That is faster than sales were growing prior to COVID-19 and means consumers are making up for some of the big declines in earlier months. The rally in “core” retail sales has benefited from fewer people eating out and transferring those dollars to grocery stores. Some of the growth came from a gradually strengthening economy and some from government programs to support people through the pandemic.

Clothing, sporting goods, hobby, book, and music stores showed the strongest monthly gains. Continued demand for new and used cars had a large impact on the overall growth. High demand for used cars and increasing prices helped push sales higher.

The weaker parts of the polling data came from three areas that are less important than retail sales but bear watching:

- Initial unemployment claims increased 53,000 in the latest report. Layoff announcements have increased. Even though the initial claims data jumped, the number of people collecting unemployment continues to slowly decline. The employment situation remains mixed.

- Inflation increased 0.2% and is only up 1.4% over the last year. Core inflation, which excludes food and energy, also increased 0.2% and is up 1.7% this year. Used car prices rose 6.7%. Without this price surge, overall inflation would have been negative last month. The Federal Reserve is targeting inflation above 2% to make up for weakness in recent years.

- Industrial production dropped 0.6%. The increased demand for goods hasn’t benefited U.S. manufacturers as much as hoped. Instead, those benefits have shifted overseas, where manufacturing focuses more on the consumer and less on capital goods such as airplanes and industrial machines.

Increasing coronavirus cases in North America and Europe also represent a risk to the economic recovery. Several European countries have reintroduced or tightened social distancing rules. Tighter rules make economic activity more difficult and generally reduce short-term demand while slowing the spread of the virus.

The polls for this month are in and show the U.S. economy is recovering. The recovery remains uneven, and some parts of the economy are not experiencing the same growth as retail markets. One final word: Economic information and political polls are key to understanding our current situation, but they may not be as important in the long run. Perhaps the most important polling data we get in coming months will be the effectiveness of the vaccines under development. Achieving a full economic recovery without some medical gains will prove very challenging.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.ft.com/content/bd86b076-12f3-4a0e-9106-3fa4e3f0ae9b

https://www.census.gov/retail/marts/www/marts_current.pdf

https://www.bbc.com/news/explainers-53640249

https://www.bls.gov/news.release/pdf/cpi.pdf

https://www.cnbc.com/2020/10/16/retail-sales-september-2020.html

https://www.federalreserve.gov/releases/g17/current/default.htm

Compliance Case: 00880873