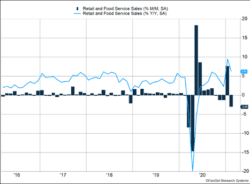

Retail sales were unable to keep pace with a stimulus-induced surge. Retail and food service sales dropped 3% in February after spiking 7.6% in January. The January data was revised 2.3% higher than first reported. Core retail sales, which exclude autos, gasoline, and restaurants, fell even farther, dropping 3.4%. Over the last year, core retail sales have increased 10.7%.

Key Points for the Week

- Retail sales fell 3% in February after surging an upwardly revised 7.6% in January because of stimulus checks.

- Severe weather and a global semiconductor shortage contributed to industrial production sliding 2.2% last month.

- The Federal Reserve raised its expectations for growth and inflation in 2021 but signaled rates are very likely to remain at current levels for the entire year.

Chinese retail sales spiked even more than the big gains in the U.S. over the last year. Retail sales rose 33.8% compared to a year ago. China’s efforts to prevent the spread of COVID-19 were extremely stringent and retail sales plummeted in the year-ago period.

The Federal Reserve met last week and indicated plans for the first interest rate increase are not expected until next year at the earliest. Many Fed officials don’t expect a rate hike until 2024 or later.

Stock markets gave back some gains last week. The S&P 500 dipped 0.7%. The global MSCI ACWI index slid 0.4%. The Bloomberg BarCap Aggregate Bond Index edged 0.3% lower on concerns about inflation.

Next week’s data releases include some key housing reports, durable goods, and U.S. personal income data, which includes an update to personal consumption expenditures data. Investors concerned by the prospect of inflation will take note as the Fed uses PCE as a key inflation barometer.

Figure 1

Surges and Shortages

There’s no denying that Americans have a high propensity to spend when given the money to do so. Unfortunately, when that check runs out, it reveals a clearer picture of where the economy is. That is exactly what happened over the past two months when looking at retail sales. Where January saw a boom in spending, February showed a comparative bust. And the fact that the global supply chain proved severely strained is making matters worse. Manufacturers in some sectors are having trouble keeping up with demand due to shortages of semiconductors, plastic, and building materials.

Last week the U.S. Census Bureau announced a disappointing report for February U.S. retail and food service sales. Retail sales decreased by 3.0% last month, compared to January, which was revised up to a 7.6% increase from the previously reported 5.3%.

The decrease in sales was felt across almost all sectors of the economy — the only sector with positive month-over-month sales growth was gasoline stations, which can be attributed to higher gas prices. The largest decrease was felt by non-store retailers (online shopping) and auto sales.

Several factors weighed on the slowing sales that were reported. First, many parts of the country experienced extreme winter weather in February. Texas struggled with three consecutive winter storms from February 10-20, bringing snow, ice, and cold temperatures that caused blackouts and food shortages for more than two weeks. When major parts of the economy are shut down due to weather, the ability to spend becomes more difficult.

Another reason for the larger-than-estimated decrease in sales is January’s surge. When figures were reported last month, retail sales showed an increase of 5.3%. January’s data being revised even higher to 7.6% makes it a difficult act to follow, especially without the benefit of stimulus checks. We expect the most recent government stimulus should lead to further increases in spending over the next several months.

The severe weather also exacerbated the ongoing semiconductor shortage. Demand for semiconductors, which are essential to the production of electronic devices, has skyrocketed over the past few years as more and more products need them to function. More recently, as the pandemic caused many consumers to shift their spending from services (airlines, hotels, restaurants, etc.) to durable goods, such as computers, video games, and high-tech exercise equipment, the demand for semis became even stronger, and production hasn’t been able to keep up. The weather in Texas caused four major semiconductor plants in Austin to shut down, worsening an already severe shortage in chips.

One of the most notable effects of the chip shortage can be seen in the auto industry. Modern vehicles rely on thousands of semiconductors, ranging in cost from a few cents to $150 each. Unfortunately, since they are necessary to run the complex computer systems in these vehicles, a few hundred dollars’ worth of semiconductor chips can stop the production of a $25,000 vehicle. Major automakers around the world are shutting down production at alarming rates, with Honda, Toyota, Volkswagen, GM, Ford, and Tesla announcing production cuts over the past few weeks. Some estimate the reduction could cost automakers more than $60 billion in lost revenue this year. The lack of vehicles coupled with strong demand may lead to increased prices over the coming months, which could contribute to higher inflation.

Overall, the latest checks that Americans have begun receiving should help the economy continue along the right path. The most important element of recovery continues to be a return to more social interaction as the pandemic winds down and more people are vaccinated. In the meantime, we should expect more choppy economic data, as government stimulus ebbs and flows.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.caranddriver.com/news/a35228204/microchip-shortage-car-production-disruption/

https://www.census.gov/retail/marts/www/marts_current.pdf

https://www.federalreserve.gov/newsevents/pressreleases/monetary20210317a.htm

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20210317.pdf

Compliance case #00986775