Slow improvement in economic data is being masked by the surging nature of government support. The gush of personal income growth in January was followed by a 7.1% decline in February. March will likely surge again with the latest round of stimulus. Employee compensation, which excludes government payments, was flat last month and has increased 0.2% over the last year.

Key Points for the Week

- Personal income shrank 7.1% in February after a January surge due to government stimulus.

- Core inflation increased only 0.1% last month and has risen just 1.4% in the last year.

- The combination of video tours, limited supply, and an urgency to move has led to 63% of home buyers making offers on homes without having physically toured the properties.

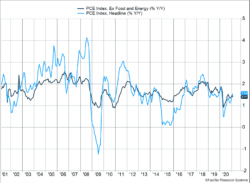

While inflation remains a concern for investors, so far the evidence of inflationary pressures has been weak. Headline PCE inflation rose 0.2% in February and is only up 1.6% over the last year. Core PCE inflation, which excludes food and energy, rose only 0.1% and is up just 1.4% over the last year (Figure 1).

Demographic and COVID-19 trends continue to support housing even as supply is constraining the market. Housing starts dropped 10.3% and sales dropped 18.3% in February, hampered by cold weather. Even with the drop, both numbers remain well above 2019 levels. The demand for existing homes has become intense. Sixty-three percent of buyers report making offers on homes without having physically toured the properties.

A sharp rally late last week pushed stocks higher. The S&P 500 soared 1.6%. The MSCI ACWI Index added 0.3%. The Bloomberg BarCap Aggregate Bond Index edged 0.3% higher as concerns about inflation subsided.

Assuming no sharp declines in the next three trading days, this week will close another strong quarter for stocks. The S&P 500 is up 6.2% so far. The U.S. employment report will headline key economic releases this week.

Figure 1

Take Me Out to the Ball Game

Major League Baseball opens its 2021 season this week, and fans will be in attendance. Concerns over international travel and social distancing remain a major challenge. The Toronto Blue Jays have relocated to Florida for a while, and most teams are limiting attendance to between 5,000 and 11,000 fans. Compared to 2020, America’s pastime is making a lot of strides back to normal. Yet, it isn’t all the way back and the specter of the coronavirus continues to hang over the season.

The same could be said of the U.S. economy. Much progress been made in protecting people from economic disaster, but a sustainable recovery is still hampered by the risk of COVID-19 and the social distancing efforts being taken to slow the virus’s spread. Personal consumption plunged 7.1% in February after being boosted by government checks in January. March income seems poised to rebound after more checks are issued but is likely to fall again in April.

The government stimulus can make it difficult to analyze the economy’s underlying health. Employee compensation provides another view that omits government stimulus from its calculation. Those results showed compensation was flat in February. The decline was likely impacted by the cold weather in February shutting down some activities. While stimulus checks are helping protect people from severe economic consequences, they aren’t creating a self-sustaining surge in employment growth or compensation for those still employed.

The good news is unemployment claims are improving from catastrophic levels. Initial claims dropped below 700,000 for the first time in more than a year. Continuing claims fell 264,000 from the previous week as the job market is showing some signs of strength.

Like baseball attendance, inflation is poised to show some significant increases in coming months. When the cardboard cutouts of last year are replaced with a dispersed set of fans, on a percentage basis it can look like a big attendance surge is afoot. The same applies to inflation. Prices dropped sharply this time last year in response to the economic slowdown. In the third quarter those prices bounced back. As we move into this statistically volatile period when inflation is likely to surge and abate, the inflation rate remains benign. Core PCE inflation rose only 1.4% in the last month. It remains a problem because it is too low, not too high (Figure 1).

For baseball fans, the important thing is games are going to be played and hopefully attended throughout the year. Vaccinations should make that more of a reality. The U.S. is averaging 2.5 million doses per day (remember some vaccines require two doses) and vaccinated well over 3 million twice last week. The longer-term economic recovery is tied closely to how quickly those individuals get out of their house and back to other activities, including attending ball games.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.statista.com/statistics/246830/average-per-game-attendance-of-the-tampa-bay-rays/

https://www.bea.gov/news/2021/personal-income-and-outlays-february-2021

https://www.census.gov/construction/nrc/pdf/newresconst.pdf

Compliance Case # 00993752