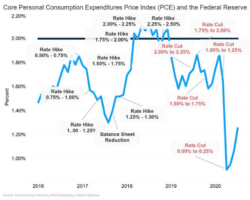

The Federal Reserve announced a major policy revision last week. The revised strategy indicates rates will stay low for a long period of time and will increase slower than in past rate cycles. The report and a subsequent speech by Fed Chair Jay Powell indicate the Fed will allow inflation to move above its 2% target to make up for periods when inflation has been less than 2%. Since core PCE inflation (ex food and energy) has been very low in the past year (see Figure 1), we expect the Fed will be slow to increase rates when the economy stabilizes.

Key Points for the Week

- The Federal Reserve revised its strategy to emphasize employment more and communicated it will tolerate higher levels of inflation in coming years to make up for a long period of low inflation.

- The S&P 500 cranked out another gain, rising 3.3% last week, and is now up 10% this year including dividends.

- Consumer spending rose just 1.9% in July, confirming the recovery slowed in response to an increased number of virus cases.

The next rate hike remains a long way off because the economic recovery has slowed. Consumer spending rose only 1.9% in July after a more rapid bounce back in the previous two months. Spending on goods remains strong as people continue to purchase automobiles and switch from services to goods in key industries, such as fitness and food. Durable goods orders surged 11.2%.

The S&P 500 continued to march higher, rising 3.3% last week and is now up 10.0% for the year. Chair Powell’s comments and some supportive economic data were enough to send the index significantly higher. The MSCI ACWI rose 2.7% despite weakness in Japan after the announcement Prime Minister Shinzo Abe will step down for health reasons. The Bloomberg BarCap U.S. Aggregate Bond Index slid 0.5%.

The U.S. employment report will be the biggest macro report this week. We’ll be looking for evidence of continued hiring or a potential slowdown as reduced consumer spending curtails the rate of rehiring. The report also asks those receiving benefits to show whether they expect to be rehired to their old job or have to find a new one. As the pandemic lengthens the time businesses are struggling to use workers, we expect some to classify their unemployment as permanent.

Figure 1

Employment Performance Appraisal

On Thursday, the head of the most powerful institution affecting economic growth gave a speech about what the organization he leads plans to do in the coming years. I am not talking about President Donald Trump’s acceptance speech at the Republican Convention, but rather Fed Chair Jerome Powell’s speech at the annual monetary policy conference normally held in Jackson Hole, Wyoming.

The speech functioned, in part, as a performance appraisal of how the Fed has done in managing interest rates and producing inflation. As part of the review, the Fed updated its Statement on Longer-Run Goals and Monetary Policy Strategy. This document lays out how the Fed sees it role in supporting the economy to provide guidance and reduce uncertainty in markets.

The revised document communicates the Fed will be more tolerant of inflation and very slow to raise interest rates when the effects of the pandemic fade. The Fed will put more emphasis on employment performance and long-term inflation expectations and will be willing to let inflation go above the stated target of 2% in order to make up for periods when inflation had underperformed expectations.

Evidence of these changes can be found both in Chair Powell’s speech and the revised document. For example, employment was previously listed after inflation in the strategy document. Now employment is ahead of inflation throughout the document, indicating it is of greater importance.

The document states the Federal Open Markets Committee will judge interest rates to be consistent with its employment goals at lower levels than in the past. This statement affirms our view rates will stay low for a long time and suggests the Fed regrets the rapid pace of rate hikes in the previous cycle. At the same time, the Fed seemed to indicate the “effective lower bound” for rates will be positive and the Fed is unlikely to initiate negative interest rates as some countries have done.

The changes to the statement reflect an environment, as shown in Figure 1, where the Fed was unable to keep inflation at its 2% target. Prior to 2019, the Fed only changed rates at meetings where there was a press conference, which was every other meeting. These meetings were coined “live meetings” and the Fed was particularly lively during this period. It raised rates or reduced other monetary support for the economy in nine consecutive live meetings despite never reaching the 2% goal.

So, even though the unemployment rate was reaching lows not seen since the late 60s, inflation was still below target. The low inflation rate forced the Federal Reserve into cancelling out three interest rate increases before cutting rates to a range of 0% to 0.25% in response to the pandemic.

From the changes and the speech, we derive several key conclusions:

- The Fed will tolerate inflation rates of around 2.5% and still not raise rates as long as inflation expectations remain anchored around its 2% target.

- Rate increases during the next cycle will occur every three to four meetings rather than every other meeting to allow a longer assessment of labor market conditions.

- Reaching full employment will gain more weight than controlling inflation when the two statistics seem to be in conflict.

- The Fed recognizes near zero interest rates raise the risk of excessive financial risk-taking and may increase rates once or twice more rapidly to normalize the lending environment before pausing.

Investors reliant on interest income, whether from CDs or bonds, will struggle in this environment. Rates will remain low and inflation is likely to be higher. If you know someone who does rely on interest for their income, we encourage you to connect them with a financial advisor for other ways of producing the dollars their retirement plan requires.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.federalreserve.gov/monetarypolicy/files/FOMC_LongerRunGoals_guide.pdf

https://fred.stlouisfed.org/series/PCEPILFE

https://www.federalreserve.gov/monetarypolicy/openmarket.htm

All data from FactSet or Morningstar Direct

Compliance Case: 00815118