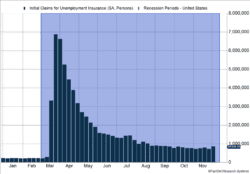

Initial jobless claims reached an 11-week high based on data reported last week. More than 850,000 workers filed initial unemployment claims (Figure 1). While processing delays around the Thanksgiving holiday affected the data, even after adjusting for the break it appears the economic lull continues.

Key Points for the Week

- Even as the first COVID-19 vaccine doses were transported, the number of newly unemployed continues to increase.

- COVID-19 has contributed to record trade deficits with China as consumers purchase more goods relative to services.

- Inflation rose only 1.2%, well below levels associated with a strong economy.

The economic pause is also taking out any inflationary buildup in the economy. The Consumer Price Index (CPI) rose just 1.2% over the last year. Core CPI, which excludes food and energy, rose 1.7%. Inflation jumped in May and June but has since returned to low levels. The lull in the economy has been focused on the service sector. Purchases of items have remained strong, and China has benefited. China is often a key part of many products’ supply chains, and its foreign trade surplus rose to $74.5 billion, an all-time record.

Stocks dipped slightly last week after a strong move higher. The S&P 500 slid 0.9%. The MSCI ACWI index dipped 0.5%. The Bloomberg BarCap US Aggregate Bond Index added 0.3% as bonds often respond positively to weaker economic news.

This week will give the market much to digest. The first COVID-19 vaccine will roll out to recipients while a second one is reviewed by the Food and Drug Administration. Congress and the Trump administration continue to seek common ground on a support package. Retail sales and industrial production in the U.S. and China will also be released. The Federal Reserve meets Wednesday and is expected to maintain its policy of low rates.

Figure 1

Avoiding Mistakes in the Post-COVID World

A 33-second video of a semi-truck leaving a plant garnered 1.9 million views on Twitter last week, and that number was climbing at last check. If you have ever seen a slow-moving truck pulling a trailer turn a corner, you can skip the video. Nothing remarkable happens, but it’s what you can’t see makes the video important. The trailer contained part of the first shipment of COVID-19 vaccine.

The vaccine in that trailer and the many trailers that will follow are likely to hasten the world’s return to a new normal. But what will a new normal look like? How do we get back to an economy showing healthy growth after a long slowdown? Japan’s economy may offer some key lessons.

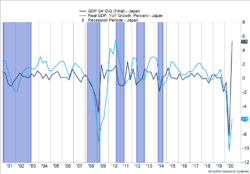

Japan has been trying to get its economy to rebound for decades. As the darker blue line on Figure 2 shows, it has spent much of the last 20 years mired in slow growth. Despite numerous and massive efforts, Japan hasn’t been able to consistently deliver a stronger economy.

The futility now has its own term, “Japanification.” It refers to an economy stuck in a low-growth environment, with little inflation and very low interest rates. In 2012, Prime Minister Shinzo Abe, who resigned due to health reasons in August of this year, tried to reinvigorate the Japanese economy and came up with his own term, “Abenomics.”

Abe’s policy had three key pillars, or arrows, which were deployed at the same time. First, loose monetary policy pushed interest rates down and improved the competitiveness of Japanese exports by pressuring its currency lower. Second, the government spent large sums to stimulate demand. Structural reform was the final arrow. Through a combination of deregulation, policy changes, and trade agreements, Abe hoped to introduce a more dynamic environment.

It didn’t work as well as desired, although the economy likely would have fared far worse without Abe’s program. One frequently cited mistake was increasing taxes on a weak economy. Japan increased consumption taxes twice in the last decade. Each time, the economic momentum that was brewing disappeared.

Further lessons are monetary and fiscal policy can only do so much and structural reforms take time. While designed to boost exports and increase labor supply, the policy changes didn’t create enough dynamism to revive the Japanese economy. Innovation can’t be mandated, and Japanese firms have faced strong competition from new and old rivals. Japan’s low birthrate also makes growth harder to achieve.

The challenges in a post-COVID world will likely be similar to what Japan has faced. Large deficits may create tension between programs designed to spur growth and individuals spending less because they are worried about the debt. Keeping taxes low and regulation focused on growth will likely make a return to economic growth easier.

Figure 2

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://twitter.com/petemuntean/status/1338116009190944769?s=20

https://www.investopedia.com/terms/a/abenomics.asp

https://www.macrotrends.net/countries/JPN/japan/gdp-growth-rate

https://www.dol.gov/ui/data.pdf

https://www.bls.gov/news.release/pdf/cpi.pdf

Statista: Trade Balance of China

Compliance Case: 00898964