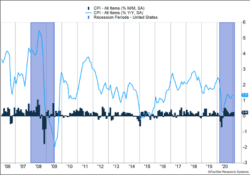

U.S. inflation rose 0.3% last month and is now up 1.4% for the year (Figure 1). Investor concern about inflation has increased in recent months against the backdrop of large stimulus packages and hopes of an economic recovery. Pushing back against that concern is a slowly recovering labor market. Initial jobless claims fell 19,000 from the previous week but remained stubbornly close to 800,000. Continuing claims were more than 4.5 million.

Key Points for the Week

- S. inflation remains well-controlled; it rose 0.3% last month and 1.4% over the last year.

- Initial unemployment claims are declining slowly as the job recovery inches ahead.

- S&P 500 earnings continue to be very strong.

The S&P 500 looks poised to produce the first quarter of earnings growth since 2019. Analysts expected S&P 500 earnings to drop 9.3% for the fourth quarter prior to reporting. With 74% of S&P 500 companies reporting, earnings are now expected to increase 2.9%. Six percent more companies than normal are beating estimates, and the margin is 15.1% compared to 6.3%.

Equity markets continued to climb. The S&P 500 added 1.3% and is up nearly 5.0% this year. The MSCI ACWI index gained 1.8% as the formation of a new Italian government supported international markets. The Bloomberg BarCap Aggregate Bond Index dipped 0.1% as concerns about inflation pushed bond yields higher. Bond prices move in the opposite direction of interest rates.

U.S. retail sales headline several key economic releases this week. January retail sales will include some of the initial stimulus checks reaching individuals and may show an extra bounce. Eurozone inflation and industrial production data from the U.S. and Europe will provide additional information on how well economies are climbing out of the pandemic-induced recession.

Figure 1

How Much Does that Cost?

For those who remember the gas lines of the early and late 1970s, inflation is a powerful memory that shapes how we look at prices. Recently, market expectations for future inflation have shot higher, feeding into a concern that government stimulus arriving at the same time as vaccine shots will expose the country to inflationary pressures. The angst deepens for some considering the Federal Reserve is simultaneously expanding its balancing sheet by issuing dollars to buy debt issued by the government.

Inflation is a risk we continuously monitor. It can eat away the value of assets and make planning for retirement very difficult. We pay attention because it matters to portfolios and financial plans.

In recent months, interest rates have reflected an increased concern about inflation. Based on bond yields, five-year inflation expectations have increased from approximately 1.5% in the third quarter to 2.4% today. Increased concern about inflation has sent bond yields higher. Ten-year Treasury bond yields have increased from 0.6% in August to almost 1.2%.

However, when analyzing inflation at a deeper level, the risk of a significant rise seems overdone. The biggest reason is inflation trends were weak prior to COVID-19. The CPI data in Figure 1 shows inflation levels just above 2% at the end of 2019. The Federal Reserve prefers a different inflation index, the core PCE index, which uses slightly different measurements and excludes certain volatile categories. It only registered inflation of 1.6% in 2019. That is well below the Fed’s target of 2%. In fact, the Fed had cut interest rates prior to COVID-19 because inflation trends were weakening even when unemployment was at a 50-year low.

The low inflation results indicated powerful structural trends keeping inflation under control. One factor was people who weren’t working returned to the labor force as wages increased. As people returned to work, the additional supply of labor kept a lid on salary increases. The ability to outsource to lower-wage countries also restrained inflation.

We expect a repeat performance. Since the pandemic began, many workers have stepped out of the labor force. Unemployment dropped sharply because many quit seeking work. Others are working part-time and would like to work full-time. Gig workers may be working reduced hours. As COVID-19 fades, we expect many of these workers to return to the labor force and the additional supply to constrain wage increases.

Even with our more sanguine outlook, we are watching key indicators to monitor whether inflation is increasing. One indicator is the velocity of money. That measures how quickly money moves through the system and indicates if people and corporations are saving or borrowing more. Since the pandemic began, money has been sent out, but much of it has been saved, causing the velocity of money to slow down and reducing the risk of inflation. Chinese inflation is another early warning indicator on our list. Because China’s economy is growing more rapidly, inflation would likely show up there first.

The areas we aren’t watching are the ones many investors watch most closely: gas and food prices. Until cost increases in these areas translate into sustained wage increases, they offer little threat to creating sustained inflation. Gas prices are a regular purchase for most people, and they are always visible. In our more energy-efficient economy, they aren’t able to create the same inflation as they did during the 1970s.

One final caveat: Annual inflation is likely to spike in coming months as the negative-inflation months from early 2020 drop off and the high-inflation months in the second quarter are included. Don’t be alarmed. As the high-inflation months drop off, the annual calculation will likely normalize. If we do see an inflation spike in coming months, it doesn’t mean we need to prepare for gas lines.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://fred.stlouisfed.org/series/PCEPILFE

https://fred.stlouisfed.org/series/DGS10

https://fred.stlouisfed.org/series/T5YIE

https://www.cnbc.com/2018/10/26/when-tracking-inflation-the-fed-thinks-this-index-is-better.html

FactSet: Earnings Season Update February 2021

Compliance Case #00954228