Chinese GDP grew 2.3% in 2020, making it the only major economy to grow last year. In the fourth quarter, the Chinese economy grew 6.5% as China continued to gain ground on the U.S. economy. The growth was led by strong performance in industrial production, which rose 7.3% in December, compared to a year earlier.

Key Points for the Week

- China’s GDP rose 2.3%, and it is the only major economy expected to report economic growth in 2020.

- Housing starts increased 12% for single-family homes, and existing homes sales in December were the highest since 2004.

- Early corporate earnings reports indicate earnings could grow in the fourth quarter rather than fall an expected 9.2%.

The U.S. housing market remains strong. New single-family housing starts increased 12% and have grown more than 1.3 million over the last year. Record low mortgage rates and the flexibility to work from home are causing many to reassess where they want to live.

U.S. corporations are also showing an impressive ability to weather COVID’s storm. Fourth quarter earnings for the S&P 500 were expected to drop 9.2%, based on estimates at year-end. With just 13% of companies reporting, expectations are now for a 4.7% drop. Given the trend, it is very possible earnings could turn positive.

Global stocks celebrated the good news. The S&P 500 soared 2.0% last week. The MSCI ACWI edged up 1.7%. The Bloomberg BarCap US Aggregate Bond Index was functionally unchanged.

Investors will get their first look at fourth quarter GDP this week. Estimates are for just under 4% growth as the economy makes up some ground while coping with high infection rates. Our view is the most important stimulus remains vaccination drives. As more people get the vaccine, we expect economic activity to pick up.

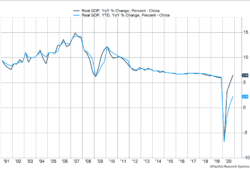

Figure 1

Focusing on the Middle Kingdom

Investors should pay more attention to the opportunities and risks China brings to the global economy. What makes China an interesting opportunity is its ability to grow its economy even during COVID. Last week, China reported its economy grew 2.3% in 2020 (Figure 1). It is the world’s only major economy expected to report growth in 2020. In contrast, the World Bank expects the U.S. economy to contract by 3.6% and for the European economy to shrink 7.4%.

China’s growth in the fourth quarter was even more impressive. GDP finished 6.5% higher than one year ago and showed an economic rally has taken hold in the country. GDP per capita, a measure of economic output per person, moved above $10,000 for the first time. China’s long period of high economic growth has produced a stronger and wealthier country.

How can China grow so much more rapidly than other countries, especially during a pandemic that originated from within its borders? China serves as a manufacturing hub for much of the world. When faced with a decision to open stores or factories, China chose factories. Retail sales fell 3.9% last year as long and strict lockdowns kept shoppers indoors and rose only 4.6% in December, signifying a weak retail environment heading into the mid-February Lunar New Year holiday. In contrast, factories boomed. Industrial production rose 2.8% last year and soared 7.3% in December.

China also benefited from other governments more focused on households (voters) and less on industrial production. Getting a check from the U.S. government protected personal balance sheets and created a wave of spending. That spending was more focused on goods than services given current restrictions. Many of those goods were manufactured in China, so China benefited from these indirect subsidies. The U.S. recorded a series of trade deficits as a result.

The emphasis on goods over services has been China’s strength, but it is also one reason China ranks as one of our top risks for 2021. Below are some risk factors associated with China:

- Industrial focus: China has used low wages and its strong infrastructure network to grow its industrial exports. At some point, other countries will take action to limit the loss of manufacturing. If China can’t transition to a more consumer-driven economy, growth will slow more rapidly.

- Wages and debt: Wages have risen steadily, and other countries may be able to compete with China more effectively. A slowdown in growth could spill over to the heavily leveraged real estate market, which has been an important source of growth.

- Trade deficits and trade wars: With the decline in services and increase in goods traded during COVID-19, China’s trade deficit with the U.S. has reached record levels and China hasn’t lived up to its commitment to purchase U.S. goods.

- Political oppression: China’s persecution of the Uyghurs and other religions has been condemned by both Republicans and Democrats. The U.S. also restricts Chinese companies from doing business in the U.S. for security reasons. The Chinese see these restrictions as an effort to protect U.S. dominance in key technology markets.

- Global ambition: China has become more geopolitically ambitious, challenging the U.S. in several arenas. Its Belt and Road Initiative, a global infrastructure strategy, is focused on translating its economic strength into international power.

These factors make any policy flareups more likely to impact markets than normal. The erosion of goodwill toward China may constrain the Biden administration’s ability to diminish challenges, and China’s emphasis on exports leaves it vulnerable to changes in trade policy or competition from other nations. China is a risk we will be watching in 2021.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.frbatlanta.org/cqer/research/gdpnow

https://www.politico.com/news/2021/01/07/trade-deficit-jumps-november-455761

https://www.wsj.com/articles/chinese-property-developers-have-huge-debts-to-refinance-11610793000

Compliance Case: 00933814