Dear Friends,

Many do not realize that retirement has its own set of rules that may be different – tax laws change, you are spending instead of accommodating, and so on. In short, making the transition from working life to retirement comes with a set of do’s and don’ts if you want that 7-figure payout.

Let’s start with the don’ts:

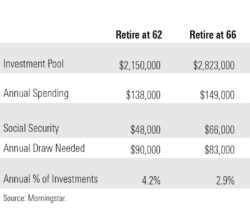

Don’t retire too early. You may be eager to retire as soon as possible, but this could be a financial disaster. For every year of early retirement, that is one less year of saving and one more year of spending. We run extensive financial plans with “what if” scenarios, but the figures below provide a quick snapshot.

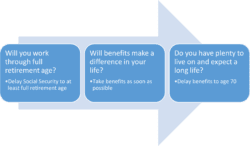

Don’t take Social Security too early or too late. So the question is, when should you take Social Security? If you take your Social Security benefits before full retirement age, it can reduce your monthly benefit by up to 30%. Delaying benefits past your full retirement age increases your benefit by 8% a year through age 70. Full retirement age is currently 66 for those born between 1943 and 1954, and it increases to 67 years old for those born later. Again, we run an extensive analysis using special software to address the Social Security collection timing issue.

|

Don’t Lock in Expensive Payments or Financial Commitments. As you start retirement, frequently helping out organizations/friends/family members in excess of your budget can threaten your retirement funds. Your savings are your means of survival for the rest of your life, so you must be smart about it. We, of course, work with you to map out what this looks like. Be Creative and Don’t Just Write Checks to Charity. If you itemize, you might get a tax benefit from writing checks to charities. If you don’t itemize, or you’re on the edge of itemizing, you may get no tax benefit from charitable contributions. A more beneficial method of charitable giving may be the donor-advised fund (DAF) which is like a charitable IRA, or the QCD, or donating appreciated securities. Now that you know what not to do, here are some suggestions of what you SHOULD do. Watch your taxable income level. I’ve found that many retirees don’t understand how much their tax status–and therefore their tax bills–can vary during retirement depending on how they manage their sources of cash. Consequently, it is essential to do tax planning before utilizing funds during retirement. Paying some tax earlier could mean more significant tax savings down the road. Roth IRA’s, Roth conversions and Roth 401(k)s all fit the bill. Consider Roth conversions. If you have more than a few thousand dollars in Traditional 401(k)s or IRAs, the period between retirement and required minimum distributions (RMDs) can present an excellent opportunity for Roth conversions. The proposed House tax laws make this strategy even more critical. Consider retirement stages and safe withdrawal rates in determining spending budgets. There has been much debate on what rate retirees should set their withdrawal at, and 4-5% has been a popular percentage for the following reasons: · You don’t have to plan for the worst-case · You likely have safety nets, such as home equity · You will probably spend less over time Having that said, we believe that a financial plan tailored to your situation is better than any “rule of thumb.” Call Us. I am not just saying this because I am a wealth advisor, but as you can see from this list, many complex financial decisions must be made before you retire. One decision can change your whole retirement and it can be very difficult to bounce back. Therefore, if you hire us (if you haven’t already), retirement planning may be one less thing you have to worry about. If you have any questions, please don’t hesitate to reach out. Debbie

THE VIEWS STATED IN THIS LETTER ARE NOT NECESSARILY THE OPINION OF CETERA ADVISOR NETWORKS LLC AND SHOULD NOT BE CONSTRUED DIRECTLY OR INDIRECTLY AS AN OFFER TO BUY OR SELL ANY SECURITIES MENTIONED HEREIN. DUE TO VOLATILITY WITHIN THE MARKETS MENTIONED, OPINIONS ARE SUBJECT TO CHANGE WITHOUT NOTICE. INFORMATION IS BASED ON SOURCES BELIEVED TO BE RELIABLE; HOWEVER, THEIR ACCURACY OR COMPLETENESS CANNOT BE GUARANTEED. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. ADDITIONAL RISKS ARE ASSOCIATED WITH INTERNATIONAL INVESTING, SUCH AS CURRENCY FLUCTUATIONS, POLITICAL AND ECONOMIC STABILITY, AND DIFFERENCES IN ACCOUNTING STANDARDS. ALL INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF PRINCIPAL. THERE IS NO ASSURANCE THAT ANY INVESTMENT STRATEGY WILL BE SUCCESSFUL. |