Every election season, political emotions run high. Candidates tell us that this is the most important election in our lifetimes. Advertisements vilifying the opposing candidate seem to never end. Political chatter on social media picks up. Through it all, it can be hard to keep our emotions under control.

Our political views can affect how many of us see the world. After President Trump was elected in 2016, the number of Republicans saying that the economy was getting better rose from 16% to 49%. The number of Democrats went the opposite, falling from 61% to 49%. Yet, not much had happened economically in that short period of time.

Our political views can also shape who our friends are. According to Pew Research, “Roughly 4 in 10 registered voters in both camps [Trump and Biden] say they do not have a single close friend that supports the other major party candidate, and fewer than a quarter say they have a few friends who do.”

Historical Returns

If our view of the economy and our friendships can be shaped by our political outlook, then it is unsurprising that our views of the stock market are shaped similarly. However, while unsurprising, it likely isn’t helpful.

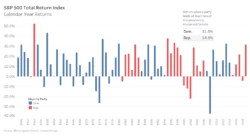

Based on data beginning in 1949, during periods when Republicans controlled at least two of the presidency, the Senate or the House of Representatives, the S&P 500 rose 14.8% per year. When Democrats held at least two, the S&P 500 rose 11.8% per year. When one party controlled all three branches, the average return was 15.0% while divided government averaged 11.5%. Both Democratic and Republican one-party control outperformed divided government, and Democratic presidents averaged a higher rate of return than Republican presidents.

The most important message is that stocks have gone up in the long run regardless of which party was in the White House or controlled Congress. Even beyond that, there just isn’t enough data to support strong conclusions that political affiliation had a direct impact over the long-term. For example, there were 70 years that Republicans were in control of two of the three governing bodies, and since the House is elected every two years, that means there were only 35 Congresses.

You should also remember that the issues you care most about may not affect your portfolios very much. Immigration, the Supreme Court and gun control are very important issues in the current presidential campaign. However, none are expected to have a large or direct effect on the performance of portfolios.

2020 Analysis

For issues that do impact investments more directly, circumstances are likely to constrain what the candidates can accomplish.

- The launch and distribution of an effective vaccine and other progress against COVID-19 is likely the most direct path to improved economic growth. Neither candidate can make anyone go to a restaurant, attend a conference or board an airplane when the virus is not contained.

- The weak economy will limit the opportunity for a Biden administration to raise taxes. Corporate taxes may increase but are unlikely to be restored to previous levels. In an economy struggling for growth and needing to find jobs for the unemployed, generating jobs will take precedence over additional revenue. Tax increases will likely be modest and limited.

- The gap between the two parties may not be as wide as normal. Trade policy with China will remain a contentious issue. President Trump has been largely successful in adjusting how Americans see China. Of Republicans, 72% view China negatively, and 62% of Democrats hold the same view.

- The lack of a follow-up to the CARES Act has increased the focus on the next aid package. Both parties favor getting aid out to Americans. The difference has been on the dollar amount and level of benefits to particular groups.

- A Republican-controlled Senate has the potential to reduce the degree of any tax increases that are proposed. Meanwhile, current differences between the Senate, administration and House created a political impasse that has delayed the passing of additional economic stimulus.

Key Takeaways

- Your financial plan isn’t based on the idea that a Republican or Democrat will always be in the White House.

- The market is driven more by fundamentals than politics. The S&P 500 earned 12.5% annually from the day President Obama was elected until President Trump was elected. From Trump’s election through October 13, 2020, the S&P has returned 15.7%. For the politically motivated, the odds are one of these wasn’t your favorite president. Yet, stocks did well under both administrations.

- Keep politics out of your portfolio. Just because an issue is important to you doesn’t mean it is to your portfolio.

- Remember — the election will soon be over!

—

Date prior to 1971 uses the S&P 500 (1936) TR Index. From 1971 on it uses the S&P 500 TR Index.

The views expressed in this material are the views of Scott Kubie through the period ended October 14, 2020 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements.