June 11, 2021

Dear Friends,

Inflation has not been a persistent and serious threat to the economy since the 1970s and early 1980s.

Having said that, the Federal Reserve knows how to defeat inflation. They can raise interest rates to onerous levels and quash demand in the economy, sometimes even creating a recession.

However, we don’t want to repeat that cycle.

At a minimum, however, we are starting to see upward pressure on prices. How long might this last?

The Consumer Price Index (CPI) jumped 0.8% in April. Remove food and energy, and so-called “core” inflation surged 0.9%, the fastest reading in 40 years (U.S. BLS, St. Louis Federal Reserve).

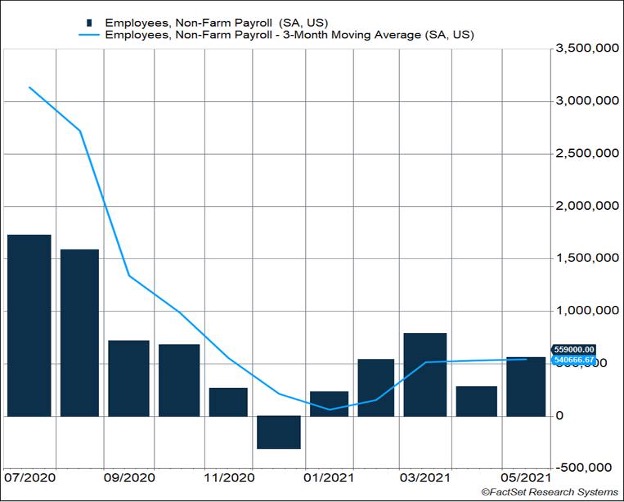

Fed officials continue to insist any increase in prices will be “transitory,” their word of choice in describing what they see as a temporary rise in prices tied to the reopening of the economy. But there are issues that are influencing pricing decisions on the production side of the economy, too. In short, production has been slower to rebound.

In April, the National Association of Homebuilders said that lumber shortages are leading to skyrocketing lumber prices, adding an average of $36,000 to the cost of a new home over the last year. Gas prices are also up 22.5% from the previous year and are the biggest contributor to an overall increase in goods and services in the nation, according to the US Bureau of Labor Statistics’ Consumer Price Index.

Government spending and a super accommodative Federal Reserve suggest that there could be a more permanent and unwanted rise in inflation. However, longer-term disinflationary trends, i.e., demographic trends and globalization, remain in place. Further, labor unions, which helped drive a wage/price spiral in the 1970s, don’t have the power they once had.

Where do we stand? There are reputable economists on both sides of the inflation debate. No one wants to see a return to the double-digit inflation problems of the 1970s, and the Fed will be more quick to react than was the case a generation ago. Yet, the Federal Reserve will be in no rush, so there will continue to be pockets of inflation, if for no other reason, due to “just in time” inventory practices.

But we don’t expect the Fed to lift interest rates any time soon, as central bankers continue to insist their focus is on full employment, and any rise in pricing pressures is temporary. The Fed is suggesting a rise in interest rates in 2023, maybe late 2022. Nonetheless, the best news on inflation is probably behind us. So be prepared for rising prices. Until The Federal Reserve raises rates, expect the party to continue, although a lot of the “easy” money has probably been made.

If you have any questions or would like to discuss any matters, please don’t hesitate to reach out.

Debbie